Seamless Liquidity for Infinite

Strategies

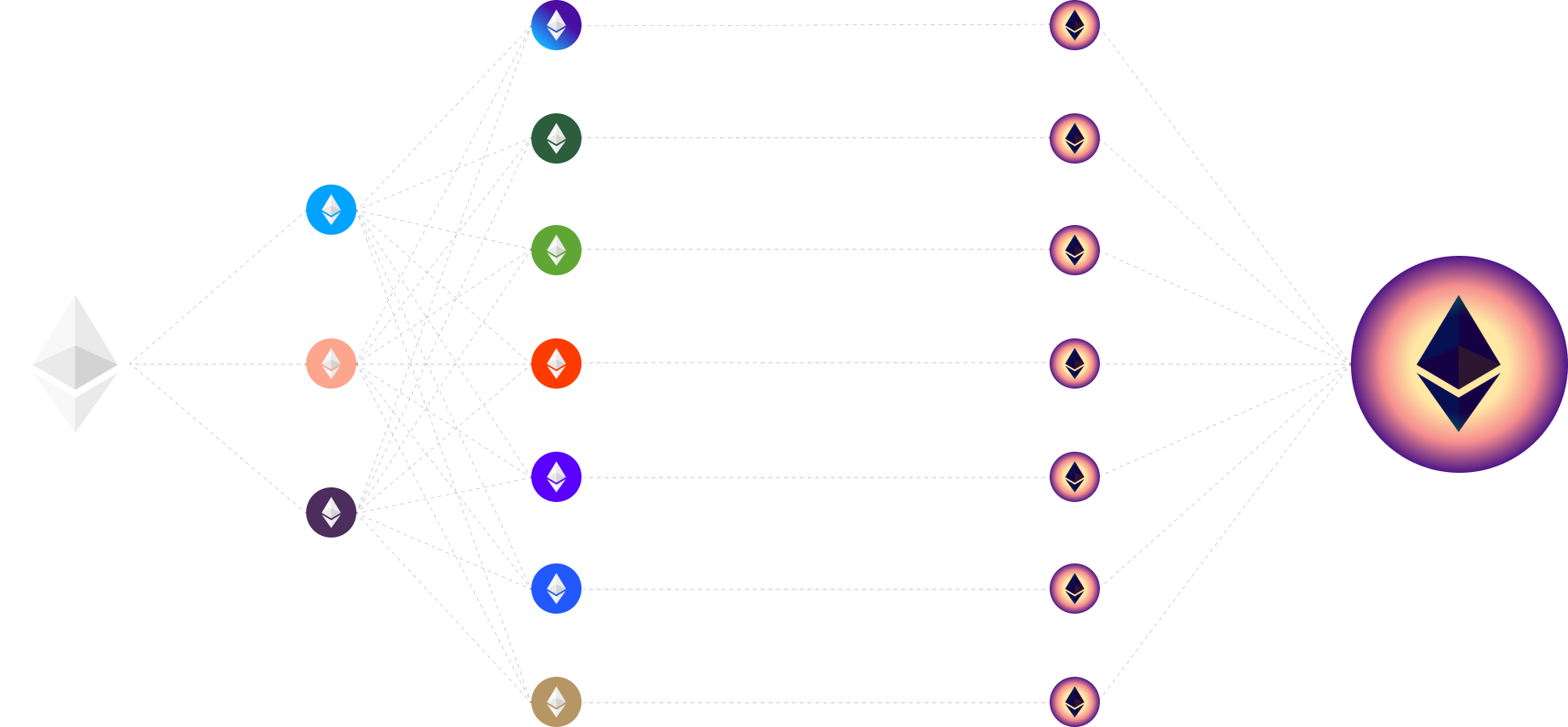

Hoenn solves liquidity fragmentation across infinite strategies, maximizing capital efficiency when slashing and AVS rewards activate.

Before

Fragmented Liquidity

Restaking strategies are powerful but fragmented—

diverse approaches split liquidity, reducing efficiency, especially with slashing and AVS rewards on the horizon

Hoenn

Unified via Synthetic ETH

Hoenn creates synthetic liquidity, or liquidity derived from synthetic assets, across a variety of restaking strategies, ensuring greater capital efficiency and risk isolation

Deposit any redeemable LRT as collateral in isolated vaults to borrow synthetic ETH, pegged 1:1 to ETH, with varying Loan-to-Value ratios.

Superior Capital Efficiency

Superior Capital Efficiency

Greater capital efficiency than spreading liquidity across multiple pools for each collateral. Hoenn’s liquidity is unconstrained by spot markets.

Enhanced Returns

Enhanced Returns

Earn more from DeFi by increasing your capital efficiency and utility, while accumulating yield on your collateral.

Risk Isolation & Stratification

Risk Isolation & Stratification

Risk is isolated and stratified to dedicated vaults with multiple layers of security, effectively managing potential bad debt.

Liquidity for Infinite Strategies

Liquidity for Infinite Strategies

Hoenn is engineered to support an unlimited range of strategies at scale, aligning with the heterogeneous nature of restaking.